VPN Market Analysis of Traffic and Brands

vpnMentor examined the traffic for our top 20 VPN providers to gain insight into which strategies result in increased visitor numbers and potential sales. We hope that the data and analyses can be used to further develop and expand the VPN market. Share

Virtual Private Networks are a growing market sector. Concerns over online privacy, censorship, and a growing desire to access geo-restricted content means more people than ever before are turning to VPNs. In fact, research suggests that 25% of global internet users now employ a VPN to secure their connection.

In order to better understand the VPN market, we examined the traffic for vpnMentor’s top 20 VPN providers. From certain patterns and irregularities that emerged, we were able to gain insight into which strategies result in increased visitor numbers.

We are sharing this information in the hope that VPN providers can find new avenues for growth.

What Are the vpnMentor Top 20?

At vpnMentor, we regularly review VPNs to give our readers the best and most reliable information regarding speed, stability, value for money, and level of customer service.

Although companies can ask us to revisit our reviews – particularly after they have made changes to their services – they cannot remove, change, or influence what we write. This means our readers can rest assured that our reviews are trustworthy and not biased in any way.

Global Company Traffic Rankings

SimilarWeb created a global ranking of websites based on the number of unique visitors to a site, as well as the number of page views those visits engender.

According to SimilarWeb, in March 2018, the highest ranked VPN website from our top 20 was ExpressVPN, at 2,445. ExpressVPN has been a major player for a long time and has proven itself with its high quality of service, so its high ranking shouldn’t surprise those familiar with the VPN market.

There’s a significant drop in ranking for the next six VPNs (PIA, TunnelBear, CyberGhost, Hotspot Shield, and IPVanish), all of which exhibit relatively similar levels of popularity. From this, we see that there is a clear frontrunner in the VPN market, followed by a pack of solidly positioned mid-size VPNs, which are in turn followed by smaller VPNs whose level of popularity varies.

It should be noted, however, that the popularity of a website (i.e. its global ranking) does not necessarily indicate the popularity of a product. Yes, many sites gain new visitors by having their product recommended by happy customers. However, there are plenty of other reasons for high volume traffic.

These include brand recognition, large advertising budgets, and quality SEO marketing approaches. From the rankings, we don’t actually know how many visits led to downloaded VPNs. Furthermore, global rankings don’t factor in bounce rates. (These will be discussed in more detail below.)

It should also be noted that the global rankings do not correlate with vpnMentor’s ranking.

| Global Traffic Top 20 | Global Ranking Position - March 2018 (Smaller number = more traffic) |

| Express | 2,445 |

| PrivateInternetAccess | 14,038 |

| TunnelBear | 14,044 |

| CyberGhost | 15,092 |

| Hotspot Shield | 18,776 |

| IPVanish | 22,763 |

| HMA | 24,180 |

| Vypr | 36,382 |

| SaferVPN | 48,662 |

| Proton | 49,381 |

| TorGuard | 52,020 |

| VPNUnlimited | 59,182 |

| Trust.Zone | 68,102 |

| PrivateVPN | 118,806 |

| Ivacy | 129,164 |

| SwitchVPN | 133,519 |

| Goose | 163,553 |

| TigerVPN | 589,004 |

| VPN99 | 31,919,700 |

Another point worth noting is that while global traffic rankings provide a view of how many people visit these websites relative to others, they do not tell us anything about the behavior of the visitors. We cannot tell whether visitors are engaging with content, searching for information, or are clicking on links by accident.

Number of Visits

The table below presents the number of visits to each website during March 2018. The meaning behind these numbers is somewhat more ambiguous than the global ranking, since the visits represented are not necessarily unique visitors. That means that while some people might be coming to the website because they’re interested in the product, others might be returning because a product isn’t performing well and they need technical support and troubleshooting.

That said, the placement of the VPNs are not that different from the global ranking, with ExpressVPN at the top, followed by CyberGhost and the other mid-size VPNs.

Where we start seeing differences is in how visitor numbers have changed during the past six months.

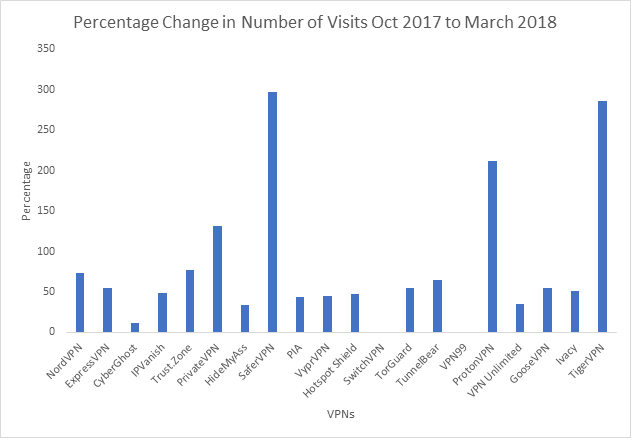

The following graph presents the percentage change of the number of visits per site from the lowest point during the past six months to the highest point. From this, we can analyze what may have caused a sudden spike or decline in traffic.

Three VPN providers stand out. The first is Proton VPN, which peaked in January 2018. This coincides with the launch of its free Android app, which was likely responsible for the spike.

The second standout is TigerVPN, which shows a 287% change in visitor numbers, with the highest also being in January 2018. If you look at TigerVPN’s total number of visits (see “Total Visits in March 2018”), however, it’s clear that the provider does not have much traffic overall. Therefore, even a small increase in the number of visitors to the site results in significant change.

Finally, the most dramatic shift can be seen in SaferVPN, which shows a 297% change, peaking in December 2017. In this case, the spike occurred in tandem with a Christmas sale.

In order to more fully understand what contributed to these changes, we took a look at which sources brought traffic to the sites.

Traffic Sources

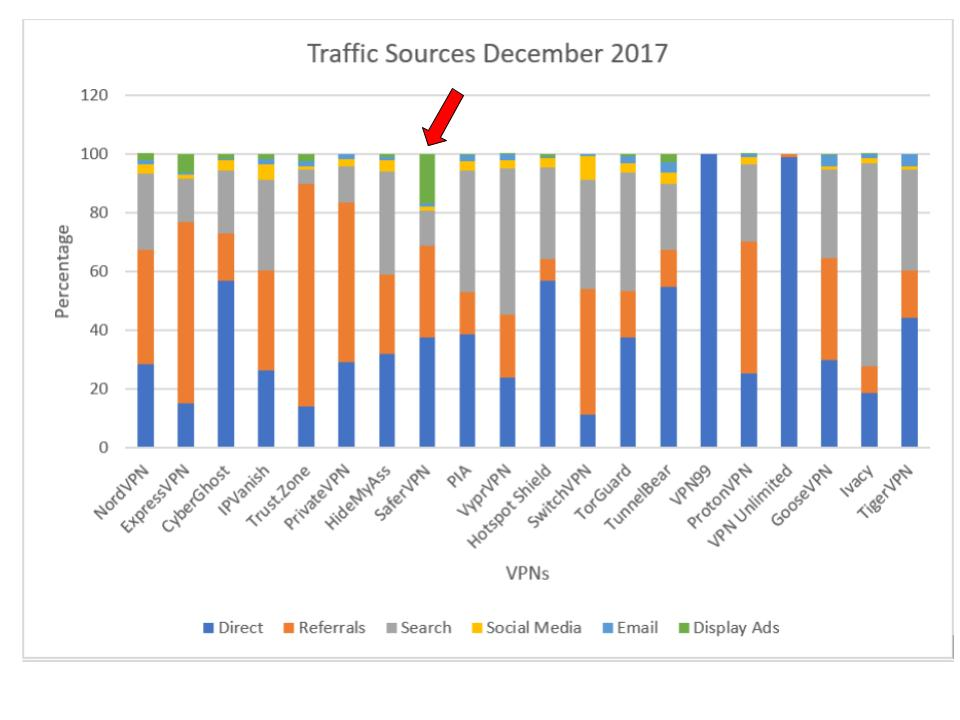

SaferVPN’s December leap can be better understood when examining the graph below. Here we see that far more than the other VPNs in December 2017, SaferVPN invested in display advertising.

Display advertising has been around for nearly 25 years, with banner ads making their first appearance in 1994. That said, it’s tricky to find a balance between creating flashy, overly colorful ads that annoy the user, and more subtle ads that fail to catch the eye – leading many in the marketing world to believe banner ads are on their way out.

This is probably why most VPN providers allocate relatively few resources to display ads.

Nevertheless, on the graph below we see that relative to other VPNs, display advertising was responsible for a fair amount of traffic for SaferVPN in December.

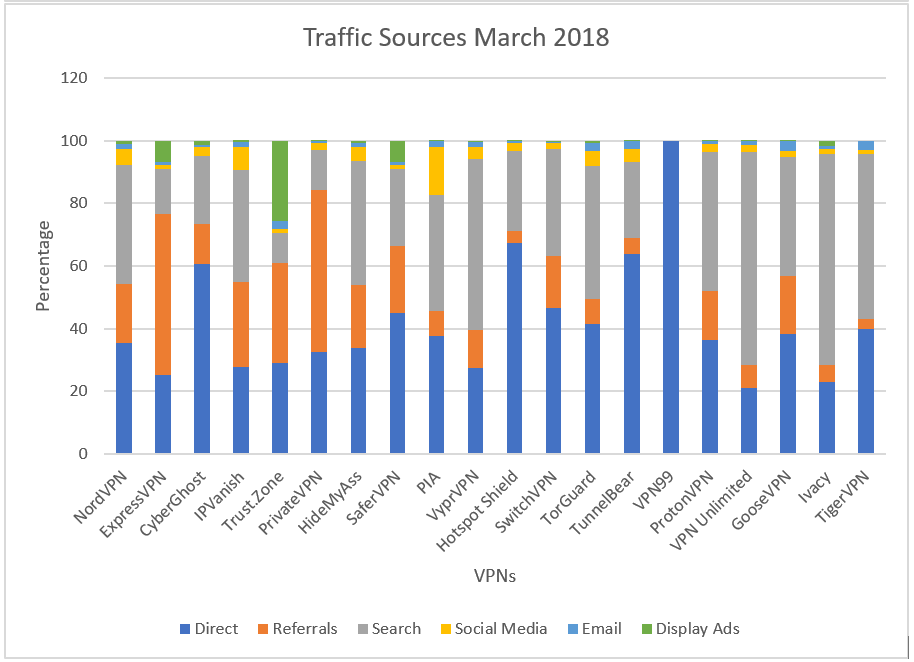

The focus on display advertising in December 2017 is even starker when it’s compared to traffic sources in March 2018.

It should be noted, however, that SaferVPN wasn’t the only VPN to offer a holiday deal. In fact, with the exception of VPN99 and VPNUnlimited, all of our top 20 did.

The only VPN besides SaferVPN to offer monthly deals under three dollars was CyberGhost. Interestingly, at $2.75 a month for three years, CyberGhost’s deals were cheaper in the long run, while SaferVPN’s deal, at $2.45 a month for two years, drew more visitors to their site.

From this, it seems that users are more interested in a lower price in the short term than more savings over the long term.

It’s likely that those who have not yet used a VPN would be particularly drawn to a short-term bargain, as they would be extra apprehensive about committing to a type of product they have never used. They would also more likely be attracted by display advertising than someone familiar with VPNs, as the latter probably has trusted sources from which they get referrals.

The above graph shows that in March, it was Trust.Zone that led the way in traffic from display ads. However, a look back at their percentage change over the past six months shows that they did not experience any particular spike. And in fact, March actually had the fewest visitor numbers of that period.

Please note: according to the graph “Traffic Sources December 2017,” VPN99 and VPNUnlimited rely entirely on direct traffic. However, because other data was incomplete, we believe this to be inconclusive. That said, traffic sources for VPNUnlimited appear to have diversified by March 2018.

Search Engine Traffic Source

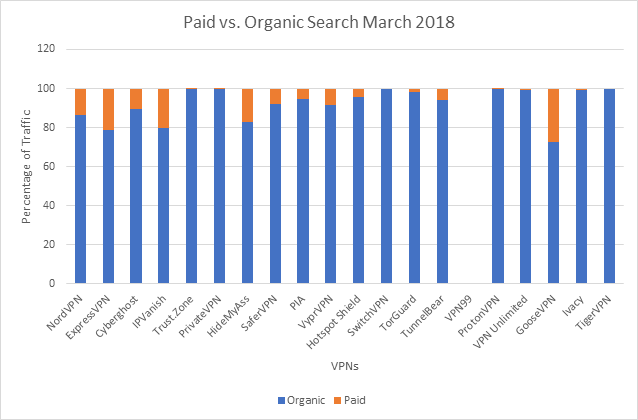

There are two ways for companies to get their websites on the first page of a search engine’s results page – organically, or through paid advertising. To reach the first page using organic means, companies must engage with their content and their users, understand SEO, and make good use of backlinks. When you pay for search results, however, it’s easy to land on page one.

Nevertheless, for these results to provide a good return on investment, they must translate into paying customers. This requires an effective marketing funnel. Every time a visitor clicks on a paid link, it costs the company money. Continuing to invest in Google Ads, for example, without the right strategy for converting visitors into customers won’t be cost effective.

If we look at the graph below, we can see that overwhelmingly, VPNs get traffic from organic search traffic. While most of the VPNs do use paid search, the most traffic any of them receive through this channel is 28% (in the case of GooseVPN).

ExpressVPN comes in second for most traffic from paid search, but this is likely because it is already so popular, it has to use all available outlets to continuously generate new visitors.

Bounce Rates

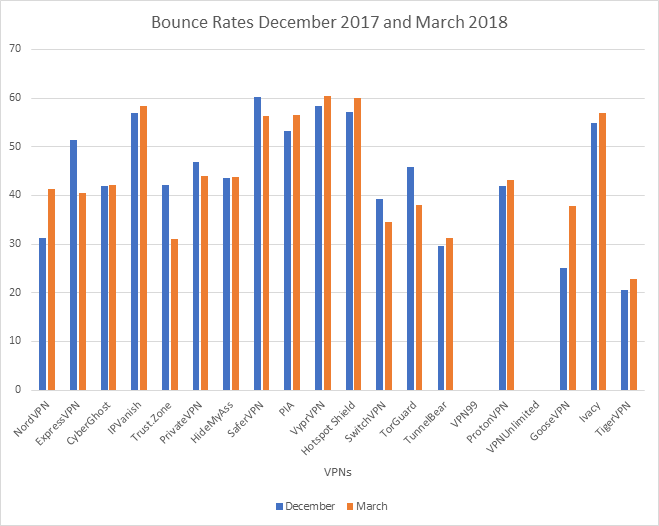

Bounce rates are the percentage of visitors that leave a site after visiting just one page – the page they land on. Consequently, for most websites, the lower the bounce rate, the better.

On the other hand, it’s possible that visitors are simply landing on the page they need, and leaving once they find the information they sought, without needing to click around the site. In this case, the fact that they’re bouncing is an indicator of the website’s success.

These variables, among others, begin to explain why there is no correlation between bounce rates and the top 20 VPNs as determined by vpnMentor.

Returning to SaferVPN’s website performance, the above graph reveals that in December 2017 it actually had the highest bounce rate of all the providers. This means that while many people came to the website, many also left before downloading the VPN.

This can be one of the effects of display advertising. People could click on an ad without really understanding what it’s for, and then realize it’s not what they want and leave. Or – especially in the case of pop-up ads – users could even click accidentally. While this would result in more traffic overall, it would be lower quality, and is unlikely to result in returns on investment.

A similar correlation between a paid means of gaining traffic and bounce rate can be seen in the case of GooseVPN. In March GooseVPN got more traffic from paid search than any other VPN (see “Paid vs. Organic Search March 2018”), and that month also saw a significant increase in the bounce rate when compared to December.

Social Media Traffic

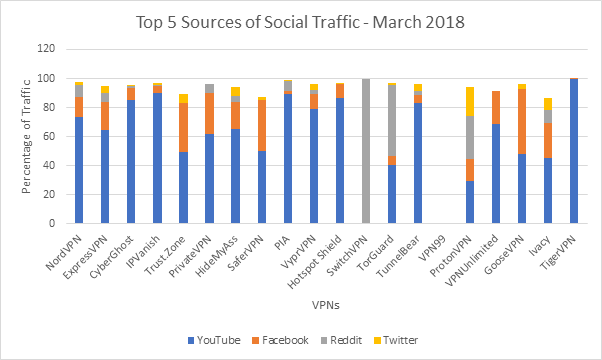

As can be seen on the graph “Traffic Sources March 2018,” social media plays a relatively minor role in bringing in web traffic. Nevertheless, given their paramount role in the internet ecosystem, it’s worth taking a closer look at which platforms are the most effective for generating visitors to VPN sites.

Note: No data was available for VPN99

As of April 2018, Facebook remains the most popular social media platform around the globe. According to Statista, its 2.2 billion active monthly users keep it leaps ahead of YouTube, which only manages 1.5 billion active monthly users.

Despite this, for VPNs, traffic from YouTube far exceeds traffic from Facebook. In fact, for 89% of our VPN providers, YouTube is the best social media platform for generating visits, and for most of these, it actually accounts for well over half their traffic. This is likely because YouTube is well-known for its tutorials and reviews.

For the remaining providers, Reddit brings in the most traffic. As in the case of YouTube, this could very well be from troubleshooting, as Reddit is a useful platform for crowdsourcing technical advice. Moreover, Reddit is a platform that’s likely to be inhabited by those who value anonymity.

Although Facebook doesn’t bring in as much traffic as Youtube or Reddit, it does generate some visits. This probably indicates less about Facebook’s usefulness with respect to VPNs than it does about the platform’s ubiquity. As the number two globally ranked website, it would be noteworthy if it didn’t play a role in web traffic.

Indeed, VPN users, who typically prioritize privacy and are wary of censorship, may harbor strong reservations towards the social media titan, Facebook. Given its not-so-stellar reputation concerning privacy and censorship, it wouldn't be surprising if this platform is approached with caution, or even outright distrust, among the VPN-savvy community.

If you’re looking to increase traffic via social media, it’s best to use YouTube rather than another platform.

Geographic Traffic Sources

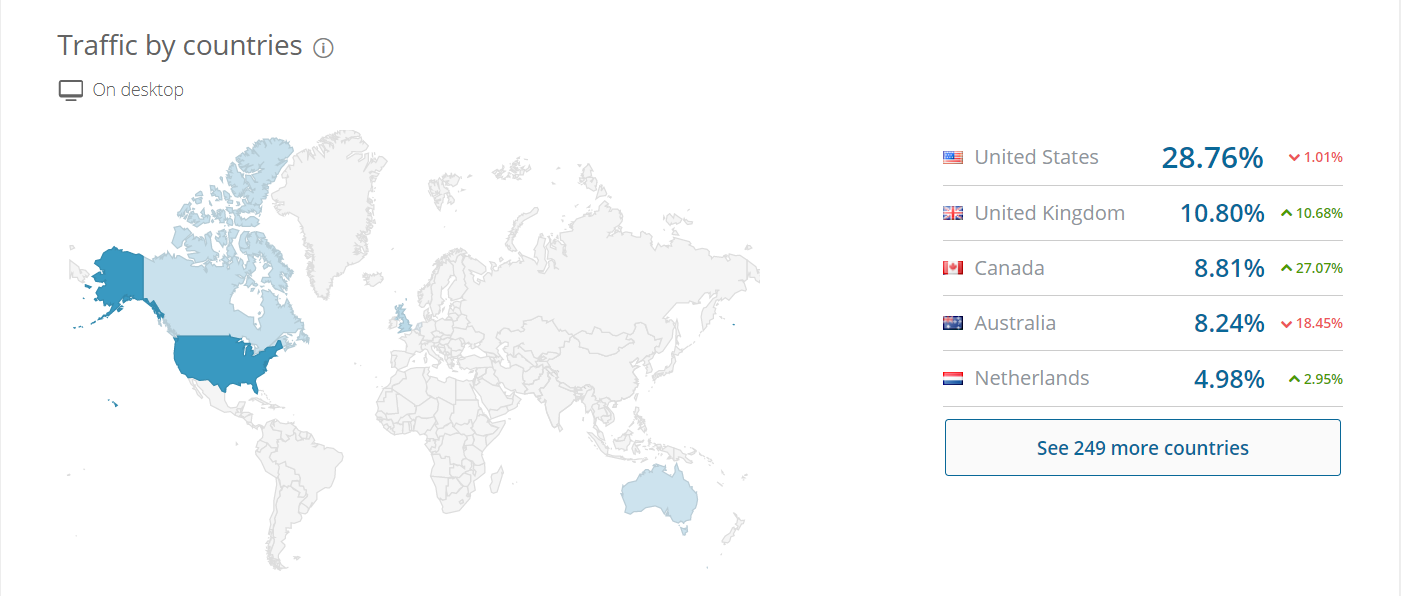

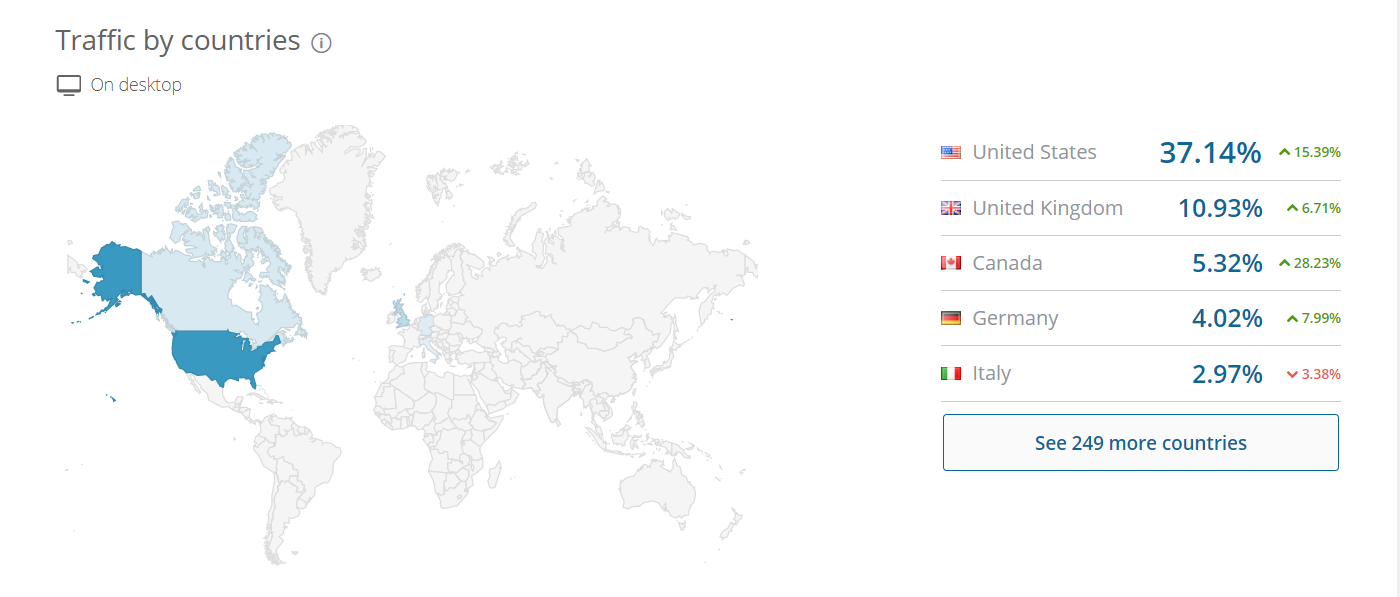

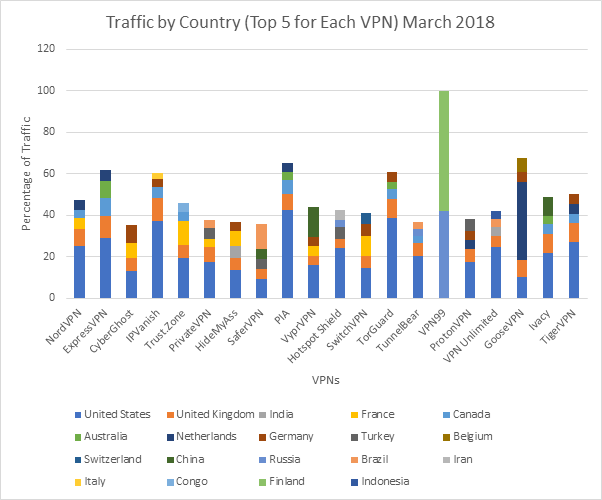

Increased censorship and a desire to safeguard one’s privacy are two of the main reasons why people choose to use VPNs. Given this, it would be reasonable to assume that the majority of traffic to our top 20 VPN’s websites would come from countries where censorship is the most prevalent, such as China, Saudi Arabia, and North Korea. However, the results from March 2018 show something very different.

Of all 20 VPNs, 85% get more traffic from the United States than from any other country, with the UK coming in at number two for 95%.

Of all 20 VPNs, 85% get more traffic from the United States than from any other country, with the UK coming in at number two for 95%.

Why is there a disparity between the countries where VPNs are most needed and the countries where our VPNs get most of their traffic?

One answer could be a lack of knowledge. For example, VPN provider sites and the websites that discuss VPNs (including vpnMentor) are banned and blocked in China.

Price is likely a factor that prevents people in the most censored countries from signing up for VPN services. Most monthly subscriptions from our top 20 VPNs cost between three and twelve dollars, so it’s little wonder that uptake is higher in more affluent countries. If this were the case, it would follow that free VPNs would be more popular in these countries.

Unfortunately, we did not conduct a thorough assessment as to whether this is true, since we only have one free VPN – Tunnelbear – among our top 20.

It should also be noted that the above graph is based on where VPNs are purchased. It’s quite possible that VPNs are being used in censored countries, but by visitors from abroad, rather than locals.

It’s also very likely that locals in countries with extensive online censorship are actually using VPNs – just not those in our top 20. For instance, AstrillVPN is known to be extremely popular in China. Therefore, the above graph should not be taken as an indicator of global VPN use in general.

Other noteworthy observations are that GooseVPN gets 38% of its visitors from the Netherlands and VPN99 gets all its traffic from Russia and Finland. The reason for the former is obvious – GooseVPN is based in the Netherlands; they therefore likely know their target audience and are adept at marketing toward it and catering to its specific needs.

Similarly, VPN99 is Russian, although the reason for its popularity with Finland is less clear. Perhaps the VPN was simply adopted by certain Finnish influencers and then spread by word of mouth.

Overall, it’s very clear that English speaking countries dominate when it comes to buying VPNs. In fact, even VPN providers that translate into other languages don’t actually see much benefit from it.

For instance, ExpressVPN is available in 16 languages, including those spoken in highly censored countries like Turkey, Thailand, North Korea, and Russia. And yet, the only non-English speaking country that ranks in their top five is the Netherlands, which accounts for less than 5% of visits.

Moreover, IPVanish, which is only available in English, has Germany and Italy in its top five, indicating that even non-English speakers are likely to search for and use VPNs in English.

With this data, it’s difficult to determine how to tap into non-English speaking markets. However, it is clear that providing translations is not a very efficient allocation of resources.

Drastic Changes in the VPN Market

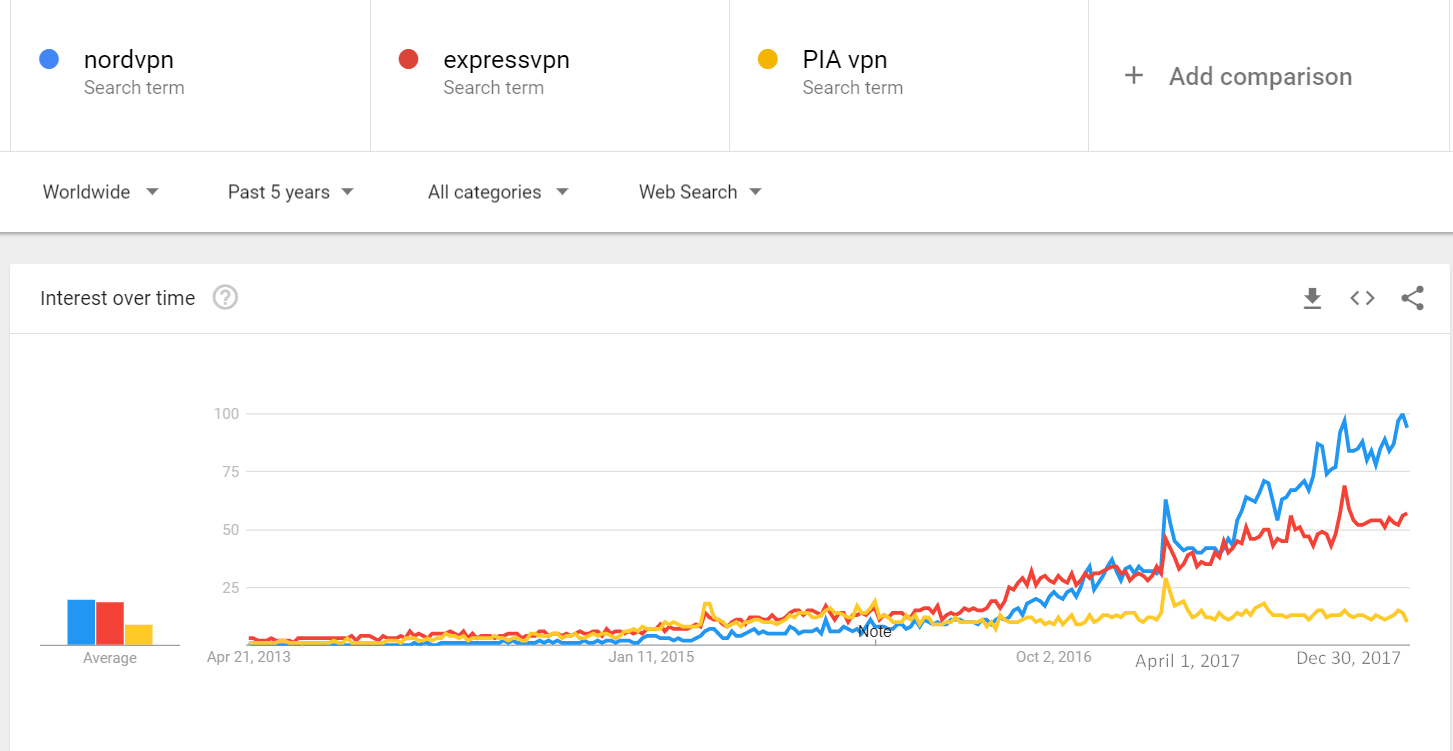

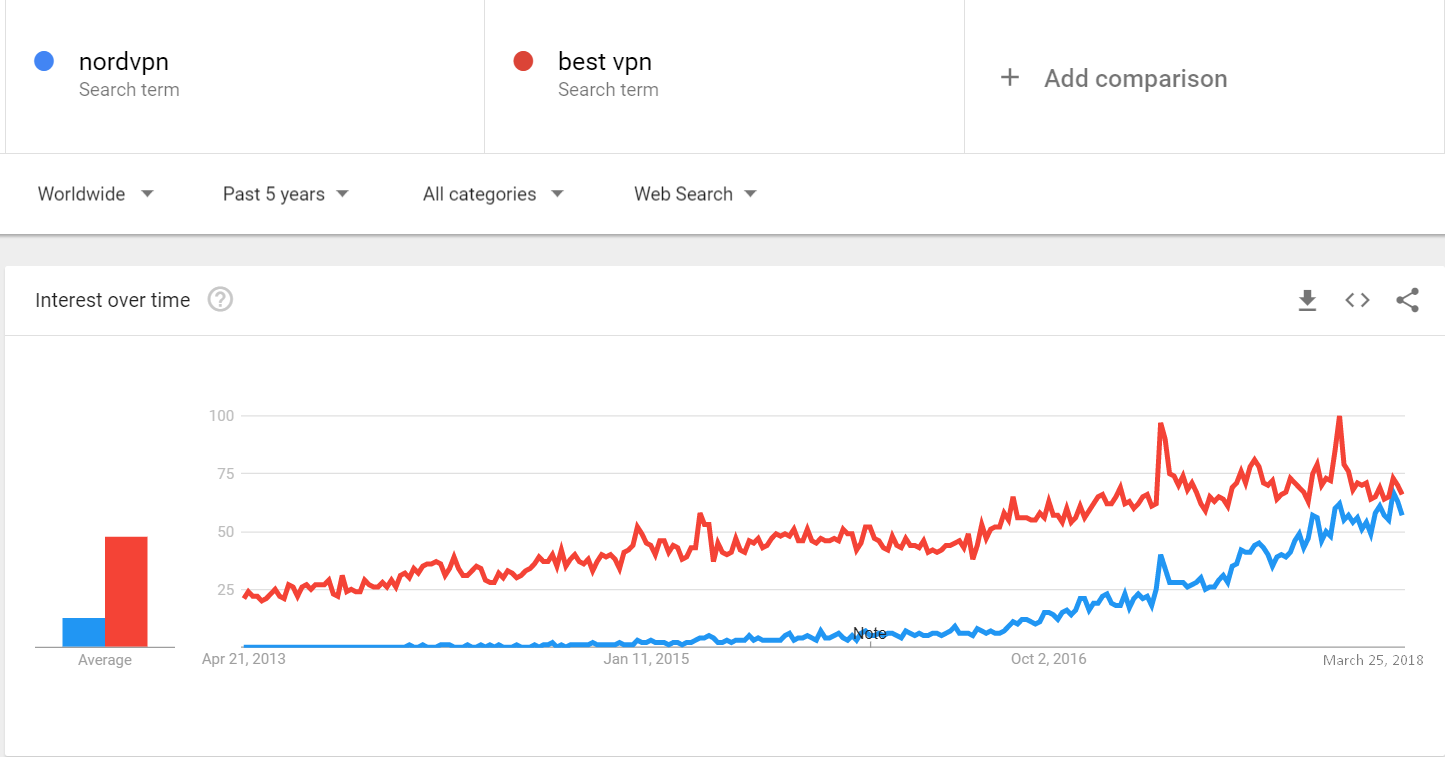

The VPN market is ever evolving. By looking at Google Trends, we can spot how different VPNs have taken over the market.

Over the past few years, the most popular VPNs have been ExpressVPN and PIA.

We can see in the graph below that at the beginning of 2016, PIA and ExpressVPN were neck in neck. Yet, by September 2016, ExpressVPN took the lead. PIA remained static and then gradually lost traction.

We already stated above that ExpressVPN and NordPVN are in a tier of their own, and this graph seems to confirm that.

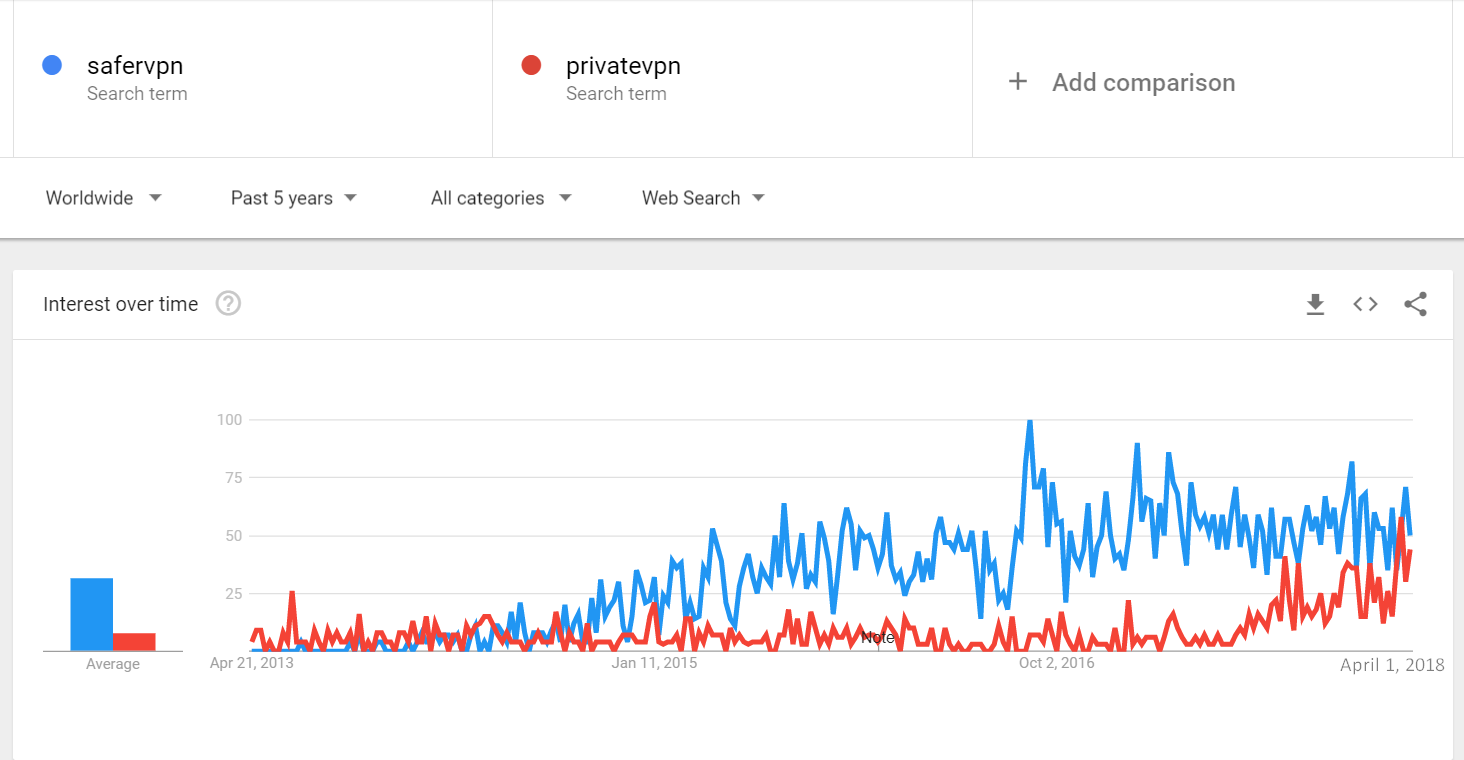

However, the mid-size VPNs, such as PrivateVPN and SaferVPN, demonstrate an evolution as well.

Even though PrivateVPN was founded in 2009 – much earlier than SaferVPN, which debuted in 2013 – the latter seems to be more popular.

It seems that SaferVPN’s deals, discounts, and display advertising pays off in terms of generating traffic.

What this shows is that it’s not only a matter how well-established a VPN is, but also how well it spreads its name and improves its service.

Conclusions

A number of conclusions can be drawn from the above analysis.

- Sales and discounts draw traffic from new users. This can be seen in the dramatic increase in traffic to SaferVPN in December 2017. In these cases, a lower price in the short term, followed by an increase in price, is more effective than a slightly higher price that would ultimately save more money in the long term. That said, traffic due to discounts can be associated with a high bounce rate, and it is unclear how much traffic results in actual sales. The takeaway should then be that discounts are a great way to get potential customers to a website – but once they’re there, an effective purchase funnel needs to be in place in order to get visitors to take action.

- Similarly, paid advertising can also be a potent means of generating traffic. This can be seen in the case of both SaferVPN and GooseVPN. However, like discounts, paid advertising tends to go hand-in-hand with high bounce rates.

- While social media is not the most effective channel for drawing visitors to a site, if a VPN provider does choose to develop this avenue, its best bet would be through YouTube.

- Although a couple of VPNs with very targeted audiences exist, overwhelmingly, VPNs are bought by English speakers. This suggests that there is little to be gained from translating VPN websites into additional languages.

We hope that the above data and analyses have provided value, and can be used to further develop and expand the VPN market.