How to Accept Bitcoin Payments with BitcoinPay

Bitcoin is the future. Learn how to setup your Bitcoin merchant account in just a few quick steps — it may look hard, but our guide makes it easy for you! Share

With bitcoin, every transaction makes the currency stronger. Just like the internet, bitcoin too can be used across borders, bypassing country restrictions and local regulations.

However, as an electronic payment system, bitcoin is predominantly used online, and requires an initial set up from those who wish to use it.

By the time you finish reading this, you will be able to start accepting bitcoin as a payment gateway on your e-commerce store, or incorporate it on your brick-and-mortar store or business.

To start accepting bitcoins:

Choose your bitcoin payment processing provider (PSP) and open a bitcoin account.

There are several websites that offer bitcoin management services, like bitpay, coinify and bitcoinpay. Each of these companies charge different fees and has slightly different features, so do your research and find the one that suits you best.

Going back to bitcoinpay.com, setting up the account is really easy. Simply click on the "Accept Bitcoin" button, enter your email, and you're good to go.

(When we first started researching for this article, we tried to open an account on bitpay, but after filling out some details we had come to learn that bitpay does not support Israeli accounts. For demo purposes, we'll be using butcoinpay.com.)

Remove restrictions by adding your bank account details

Although bitcoin transactions are anonymous, new accounts are limited to $1000 worth of transactions per month by default. To remove that limitation, merchants must provide their personal information for verification purposes. This may include a copy of your ID or passport, names and addresses of company directors and address of incorporation.

Choose your currency

Once opening your account, you will be asked which currency you want your bitcoins to convert to when they are paid out to your bank account. While fees and exchange rates are slightly different with each PSP, bitcoinpay recommends working with EUR, as that will dramatically reduce the amounts of fees paid for each transaction.

As for pricing, you can charge your end customers in USD currency and still get paid in EUR. Exchange from USD to EUR is provided at SPOT exchange rate and does not involve any commission.

Check Bitcoin Price converted to USD, EUR or GBP using this tool.

Accept bitcoin payments at your point of sale

Now that your account is all set up, you're ready to start accepting bitcoin payments.

For a brick and mortar business, the simplest way to do this is by sending an email to your customers that contains a payment link. Alternatively, you can provide your customers with a unique QR code, which can be generated on the bitcoinpay website.

Of-course, customers who wish to pay with bitcoin should have their bitcoin wallet setup.

Accept Bitcoin payments on your website

BitcoinPay provides an API that is compatible with most of today's eCommerce platforms, including websites and mobile applications. Code samples with mock server testing are accessible in various languages such as PHP, Java, Python, Ruby, Perl, among others. They even offer a specifically designed button generator for beginners.

But here's the best part: If you don’t know how to code, you can still integrate bitcoinpay relatively easily by downloading one of their dedicated plugins for opencart, magento, prestashop and woocommerce. Simply navigate to the developers section and download the required plugin. Then upload it to the backend of your website and configure the settings according to your needs.

How are payments sent and received?

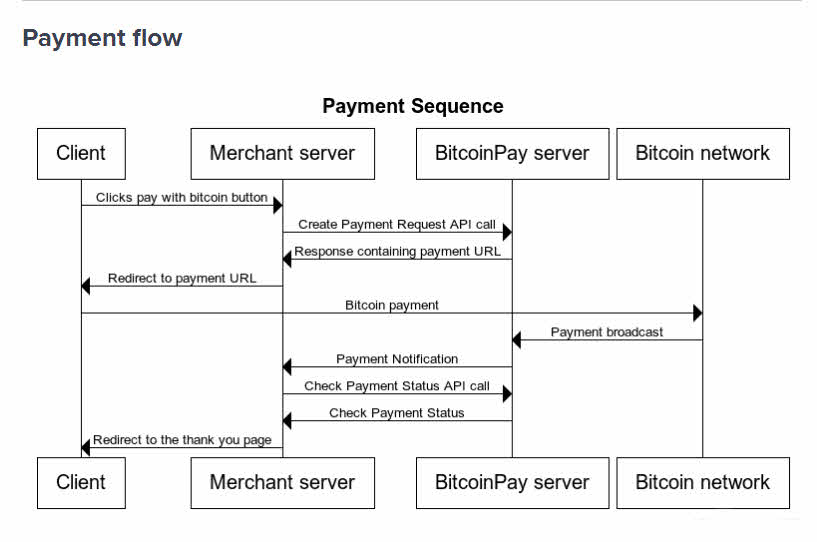

To give you a better idea of how bitcoin actually works, here's the sequence of actions that occur when a client hits the "Pay with bitcoin" button.

What to do next?

After receiving bitcoin payment, you have several options:

- Keep bitcoins in your bitcoin wallet to use for your own purchases.

- Automatically convert and deposit bitcoins into your bank account. You can configure a certain threshold for deposits or define recurring deposit dates.

- The Split option allows you to define how much of your bitcoin earnings should be deposited in your bank and how much of it should stay in your bitcoin wallet.

The above options are some very basic examples of how money can be automated with bitcoin. There are many other actions can be configured and automated according to your business needs, such as paying employee salaries, creating new orders from suppliers when stock is low, or paying bills, in countries that allow it.

To sum things up, while bitcoin is still well underway in competing with traditional financial systems, it is clear that this amazingly flexible currency is here to stay, and may change our lives forever. Hop on the bandwagon by signing up for a bitcoin account today.